The Mortgage Broker Job Description PDFs

Wiki Article

Some Of Mortgage Broker Job Description

Table of ContentsMortgage Broker Job Description Can Be Fun For AnyoneThe Buzz on Mortgage Broker AssociationAll About Mortgage Brokerage10 Easy Facts About Broker Mortgage Near Me DescribedSome Ideas on Mortgage Broker Assistant Job Description You Need To KnowThe Definitive Guide to Broker Mortgage Near MeAbout Mortgage Broker Average SalaryThe Ultimate Guide To Broker Mortgage Calculator

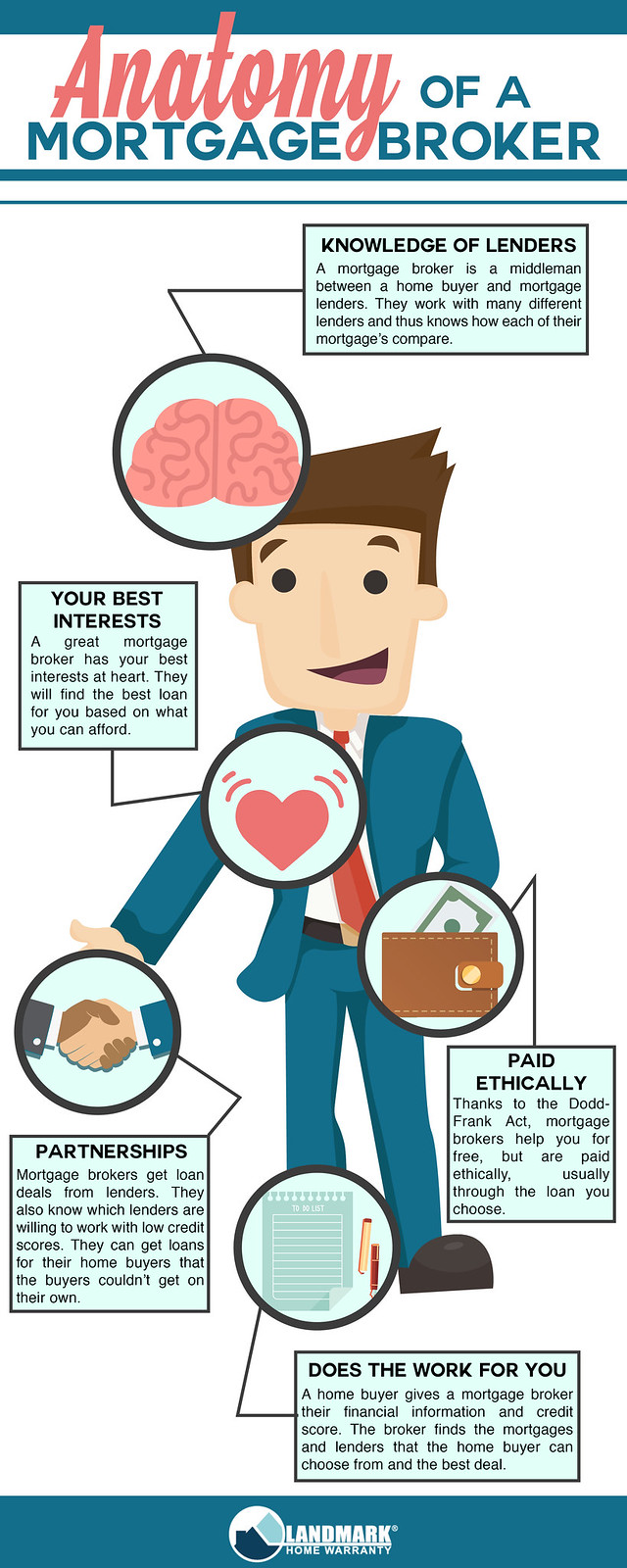

What Is a Mortgage Broker? A home loan broker is an intermediary in between an economic organization that offers lendings that are secured with property and people interested in purchasing actual estate who require to borrow cash in the type of a finance to do so. The home mortgage broker will deal with both celebrations to obtain the individual approved for the financing.A home loan broker typically works with various lenders and also can provide a selection of funding alternatives to the borrower they collaborate with. What Does a Home loan Broker Do? A mortgage broker intends to finish actual estate deals as a third-party intermediary between a borrower and a lender. The broker will collect details from the private and also most likely to numerous loan providers in order to locate the very best potential lending for their customer.

What Does Mortgage Broker Vs Loan Officer Do?

All-time Low Line: Do I Required A Home Loan Broker? Collaborating with a home mortgage broker can conserve the customer effort and time throughout the application process, and also possibly a great deal of money over the life of the lending. Additionally, some loan providers function solely with home loan brokers, suggesting that borrowers would certainly have access to fundings that would certainly otherwise not be available to them.It's important to examine all the costs, both those you might need to pay the broker, along with any kind of fees the broker can assist you prevent, when considering the choice to work with a home mortgage broker.

Mortgage Broker Average Salary - The Facts

You've probably heard the term "home mortgage broker" from your realty agent or friends who've purchased a house. However just what is a home loan broker as well as what does one do that's different from, claim, a financing officer at a bank? Geek, Budget Guide to COVID-19Get answers to questions regarding your mortgage, traveling, finances and also maintaining your comfort.What is a home mortgage broker? A home mortgage broker acts as an intermediary in between you and prospective lending institutions. Mortgage brokers have stables of lenders they work with, which can make your life easier.

Mortgage Broker Can Be Fun For Everyone

Just how does a home loan broker obtain paid? Mortgage brokers are most frequently paid by lending institutions, in some cases by consumers, but, by legislation, never both.The competition as well as home rates in your market will contribute to dictating what home loan brokers fee. Federal law restricts how high compensation can go. 3. What makes home loan brokers different from lending officers? Loan policemans are staff members of one lending institution who are paid established incomes (plus incentives). Financing policemans can write just the kinds of lendings their employer picks to provide.

An Unbiased View of Broker Mortgage Rates

Home mortgage brokers may be able to provide consumers access to a broad choice of financing kinds. You can save time by utilizing a home mortgage broker; it can take hours to apply for preapproval with different loan providers, after that there's the back-and-forth communication included in underwriting the funding and also making sure the transaction stays on track.When selecting any lending institution whether with a broker or straight you'll want to pay interest to lender costs." After that, take the Car loan Price quote you get from each loan provider, position them side useful site by side as well as compare your passion price and all of the charges and closing costs.

The Facts About Mortgage Brokerage Uncovered

How do I select a mortgage broker? The finest way is to ask close friends as well as relatives for references, yet make sure they have actually used the broker as well as aren't just dropping the name of a former college roommate or a remote colleague.

Little Known Facts About Mortgage Broker Assistant.

Competitors and house rates will certainly affect how much home loan brokers get paid. What's the difference between a mortgage broker and a funding officer? Car loan policemans function for one lender.

An Unbiased View of Mortgage Broker Meaning

navigate hereInvesting in a new house is among one of the most complicated occasions in an individual's life. Properties differ greatly in terms of style, features, college district as well as, naturally, the constantly important "area, place, place." The home mortgage application procedure is a challenging element of the homebuying procedure, particularly for those without past experience.

Can establish which concerns could develop troubles with one loan provider versus one more. Why some customers avoid home mortgage brokers Often property buyers really feel more comfortable going straight to a huge bank to secure their finance. Because instance, buyers ought to at the very least consult with a broker in order to comprehend all of their options concerning the kind of finance as well as the available rate.

Report this wiki page